Overview

Introduced: June 2023

Effective from: January 1, 2024 (for annual reporting periods beginning on or after this date)

Last modified: N/A

Region(s): Global (Adoption varies by jurisdiction)

About

The International Sustainability Standards Board (ISSB), established by the IFRS Foundation, introduced its first two global sustainability standards:

-

IFRS S1: General Requirements for Disclosure of Sustainability-related Financial Information

-

IFRS S2: Climate-related Disclosures

These standards provide a global baseline for sustainability-related financial disclosures, addressing the growing demand for consistent, comparable, and reliable information on sustainability risks and opportunities, particularly for investors.

These standards create a global baseline for investor-focused ESG disclosures, structured around the four pillars of the Task Force on Climate-related Financial Disclosures (TCFD) which was fully integrated and disbanded in 2023): governance, strategy, risk management, and metrics & targets. The ISSB framework is designed for use in capital markets and intended to be interoperable with other standards, including the EU’s ESRS.

The ISSB standards were officially endorsed by the the International Organization of Securities Commissions (IOSCO) and are being adopted across jurisdictions representing over half of global GDP and GHG emissions.

Criteria for compliance

Entities covered

-

Large publicly listed companies and financial market participants in jurisdictions that have adopted or are in the process of adopting the ISSB standards

-

Implementation and enforcement vary by country, depending on local regulatory decisions

-

The standards are voluntary globally, but mandatory where adopted into law

Emissions reporting

- IFRS S1: Requires the disclosure of material sustainability-related risks and opportunities that could affect the entity’s cash flows, access to finance, or cost of capital.

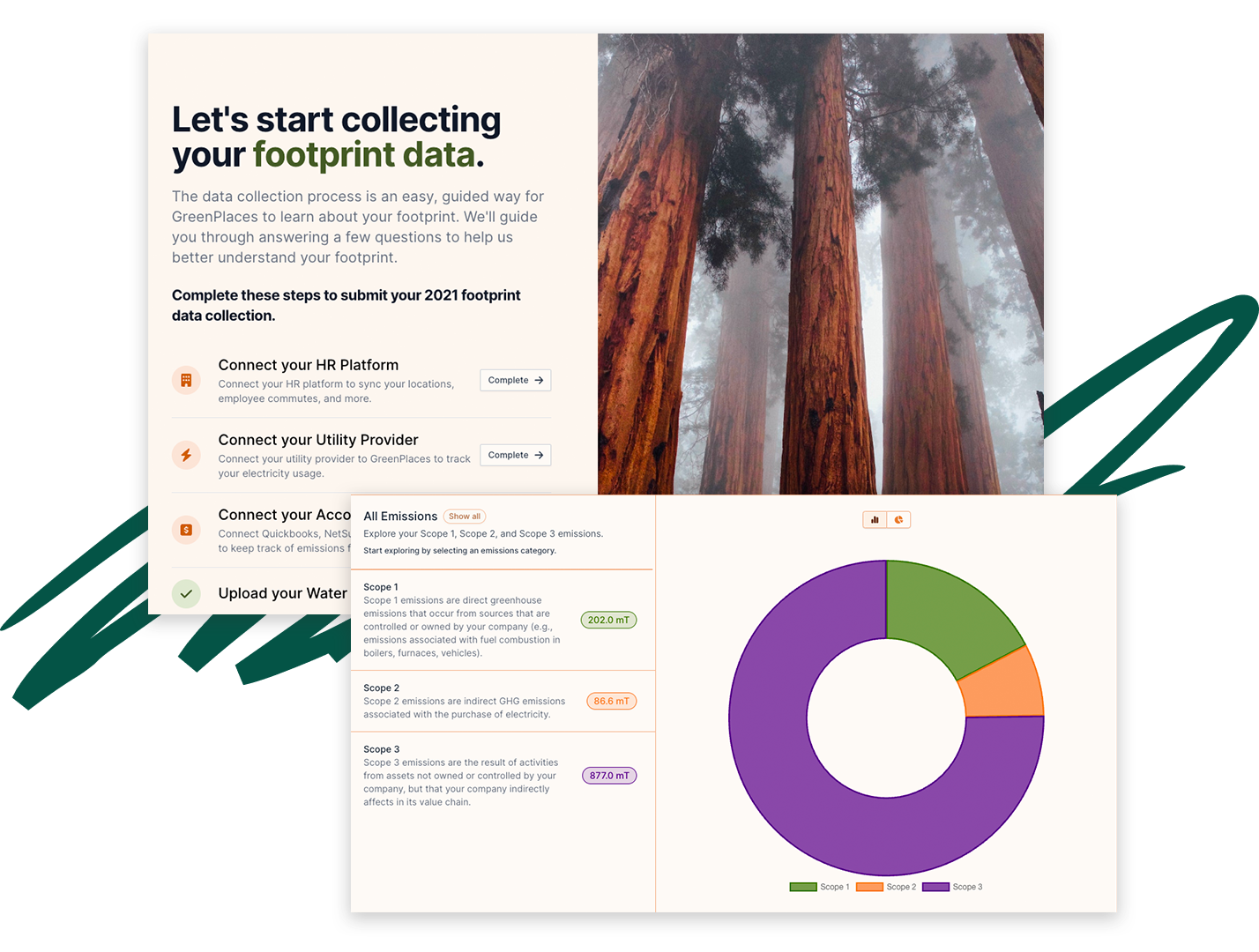

- IFRS S2: Specifically mandates the disclosure of Scope 1, Scope 2, and Scope 3 greenhouse gas (GHG) emissions, following the GHG Protocol Corporate Standard.

Compliance timelines

-

January 1, 2024: Effective date for reporting periods starting on or after this date, subject to local jurisdictional endorsement

-

Transition reliefs: Companies may begin with IFRS S2 (climate disclosures) and defer certain IFRS S1 disclosures during the first year

-

Jurisdictional adoption: Ongoing—each country sets its own effective dates and phase-in approach

Disclosure requirements

IFRS S1: General sustainability disclosures

-

Identification and disclosure of material sustainability-related risks and opportunities

-

Disclosures organized by governance, strategy, risk management, and metrics/targets

-

Sector-specific disclosures using industry guidance such as SASB Standards

-

Applies across time horizons (short, medium, and long term)

IFRS S2: Climate-related disclosures

-

Disclosure of climate-related physical and transition risks

-

Required disclosure of Scope 1, Scope 2, and (if material) Scope 3 greenhouse gas emissions, aligned with the GHG Protocol

-

Scenario analysis and climate resilience evaluation

-

Transition planning and net-zero targets

-

Industry-specific metrics and targets based on SASB guidance

Third-party auditing

-

ISSB does not mandate assurance, but disclosures are structured to be verifiable

-

Most jurisdictions are expected to require limited or reasonable assurance as part of financial reporting regulations

-

Independent assurance may be required for specific data points (e.g., emissions)

Penalties for non-compliance

-

No penalties imposed by the ISSB itself

-

Enforcement and penalties are determined by national regulatory bodies in jurisdictions that mandate compliance

-

Penalties may include regulatory fines, delisting risks, or investor litigation depending on local law

Global adoption

The following countries and regions have committed to aligning with or adopting the ISSB standards (status may vary by sector or disclosure phase):

-

Brazil

-

United Kingdom

-

Canada (pending regulatory finalization)

-

Japan

-

Singapore

-

Turkey

-

Sri Lanka

-

Indonesia (starting 2027)

-

Others in progress or under consultation